Black Tuesday

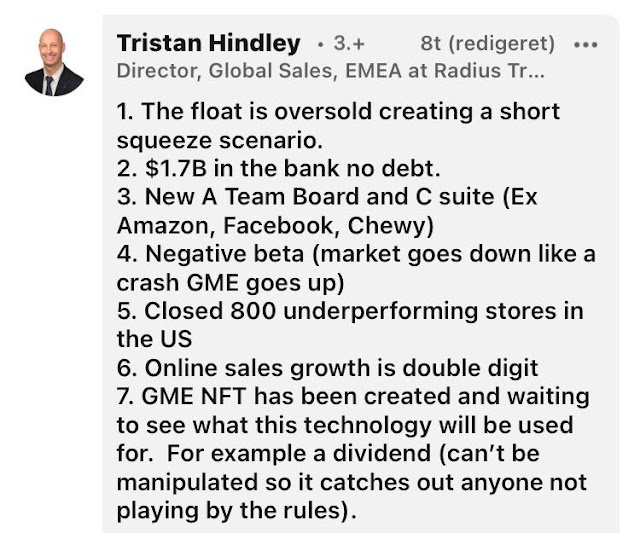

Image credit to: @marcjonesrtrs See a snapshot of Chinese property sector bonds crashing. This contagion will spread. As my Financial Advisor friend once told me, the bigger the bubble, the bigger the crash. Everything is not well in finance right now. In Bitcoin, I see "Buy the rumor, Sell the news" happening as the Bitcoin Futures ETF launches today. This ETF is NOT good for retail investors. @CryptoWhale As Crypto Whale predicts, Bitcoin will crash just like it did in 2018 when the CME Bitcoin Futures was launched. See image below. @CryptoWhale If you lived through 2018, then you know the pain I am speaking about. Once the margin calls start, it is too late to get your money out. On the Investment front, I am HODLing GME and SPXS as crash insurance. It is a type of barbell. The fundamentals of GME keep improving daily. Not too mention all of the new hires they acquired from other tech companies recently. You can view the chart to see the GME Tech Hire Database below. A...