Short Hedge Funds Fail To Tank GME

Hedge Funds fail to tank the price of GME after a great quarter. You can see the manipulation of the price after hours to trick investors into selling. No one sold and within 24 hours, the price of GME rebounded to where it was when great earnings came out.

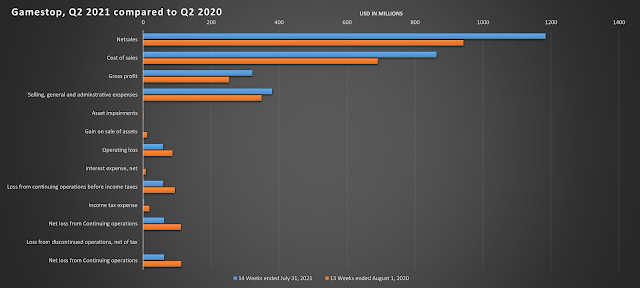

You can see in this infographic how GameStop, Q2 2021 compared to Q2 2020. I will not go into detail about this but the graphic pretty much says it all. GME is becoming a tech company and the transformation is happening in real time.

Interested in learning more? Explore our Connecticut SEO Agency and delve into our Bitcoin Blogspot for a wealth of free, original content. Don't miss out—share this post, and thank you for reading!

I own GME and like the stock. This crypto blog is my opinion and should not be construed as financial advice.

You can see in this infographic how GameStop, Q2 2021 compared to Q2 2020. I will not go into detail about this but the graphic pretty much says it all. GME is becoming a tech company and the transformation is happening in real time.

A ton of information is surfacing on Reddit and the Internet in general about GME vs the evil competition. Did you know that it is Amazon's fault that Blockbuster, Sears and Toys “R” Us went bankrupt. Yes, Amazon teamed up with some short hedge funds to co-opt the above companies and force them into bankruptcy. Some people are now boycotting Amazon including Whole Foods due to outrage.

Funny, now that GME is thriving, Blockbuster, Sears and Toys “R” Us the stocks are pumping 1,500% from the grave. Retail can't buy these holding companies but you can buy GME. GameStop is the White Knight in the markets.

If you weren't paying attention, Bitcoin crashed on 9/7/21, the day before GME earnings. This isn't a coincidence as these short hedge funds needed liquidity to suppress GME at earnings. I predict that Bitcoin just had a dead cat bounce and will trend lower.

As I have stated in a previous article, I think GME today is like buying Bitcoin in 2014. I know because I did it. The company is evolving fast as hell and is turning into a disruptive tech company. Just look at the e-commerce talent hired away from Amazon and others. Not to mention, the GME website rankings are improving daily. These improving fundamentals and business transformation are clearly visible. There is 100% chance that the mother of all short squeezes (MOASS) will happen.

Funny, now that GME is thriving, Blockbuster, Sears and Toys “R” Us the stocks are pumping 1,500% from the grave. Retail can't buy these holding companies but you can buy GME. GameStop is the White Knight in the markets.

If you weren't paying attention, Bitcoin crashed on 9/7/21, the day before GME earnings. This isn't a coincidence as these short hedge funds needed liquidity to suppress GME at earnings. I predict that Bitcoin just had a dead cat bounce and will trend lower.

As I have stated in a previous article, I think GME today is like buying Bitcoin in 2014. I know because I did it. The company is evolving fast as hell and is turning into a disruptive tech company. Just look at the e-commerce talent hired away from Amazon and others. Not to mention, the GME website rankings are improving daily. These improving fundamentals and business transformation are clearly visible. There is 100% chance that the mother of all short squeezes (MOASS) will happen.

GME has a negative Beta, meaning when the market goes down like a crash, GME goes up. We may be seeing this unfolding right now. Capitulation is near and the signs are everywhere. Just look at the Chinese market crash. In 2020, the short hedge funds preyed on Retail investors. In 2021, Retail is preying on SHFs.

The hive mind started out dumb but is getting highly intelligent by the day. What a crazy world we live in.

Interested in learning more? Explore our Connecticut SEO Agency and delve into our Bitcoin Blogspot for a wealth of free, original content. Don't miss out—share this post, and thank you for reading!

I own GME and like the stock. This crypto blog is my opinion and should not be construed as financial advice.

Comments

Post a Comment